The Pinbar Trading Strategy Guide

Contents:

Then you have this pin bar over here, or maybe an engulfing pattern, whatever you call it. Well, what I would encourage you to do is to trade with the trend on the higher time frame. How do we know which stock is going to form pinbar, how to sort the stock for the next day for pinbar strategy. Hi Rayner, thanks for the lesson on pin bars, really good.

The same is true for bearish pin bars but in the opposite direction. The bearish pin bar is located at the end of a bullish trend and its longer candle wick is the upper area. In this manner, the longer wick is sticking out above the price action. The bearish pin bar is usually a good sign of an upcoming price reversal in the bearish direction. A valid, tradeable bullish pin bar is located at the end of a bearish trend and its lower candle wick goes below the overall price action. If you spot a bullish pin bar setup on the chart, this will setup a nice opportunity for a long position.

Pattern 80-20: Trap for plankton

The pin bar strategy is based on a simple, yet proven assumption that forex pairs come into resistance during a rally, but are often able to break through it. When this occurs, the former resistance becomes the new support. Once the market finds support at a former resistance, a bullish pin bar is formed in the process. The pin bar set up is an easy way to visualize trend reversals in the market.

I’m simply trying to convey the basic fundamentals behind why pin bars work. Human rational and emotions carry over into their trading decisions, which is what moves the market. Conservative stop-loss can be set behind the nearest support/resistance level behind the eyes. A less conservative approach would be to set stop-loss to immediately behind the nose bar point (in this case, your reward/risk ratio may suffer). Now I’m here to help you learn how to develop your own strategies, autonomously.

How to spot a pin bar pattern

If you are going long at your fx broker, enter long when the next candle opens and ticks above the high of the bullish pin bar. A valid pin bar is one, wherein the wick goes above the price action. The highest probability pin bars are reversal signals that come after a prolonged price move.

What Are Leading and Lagging Indicators in Crypto Trading? – MUO – MakeUseOf

What Are Leading and Lagging Indicators in Crypto Trading?.

Posted: Sat, 03 Sep 2022 07:00:00 GMT [source]

Stop-loss is placed at behind the point of the nose bar (in this situation, even conservative stop-loss wouldn’t be hit, as the price pull-back during the right eye happened before the entry). Take-profit is set at the nearby support level and is easily filled. To effectively trade the pin bar formation, you need to first make sure it is well-defined, . Not all pin bar formations are created equal; it pays to only take the pin bar formations that meet the above characteristics.

How to Trade the Head and Shoulders Pattern

The Japanese have a slightly different name, which translates to “https://forexhero.info/” for the bearish pattern or ‘hammer’ for the bullish pattern. The best way to learn about Pin Bars is to open up some charts and try and find some for yourself. Once you have found a selection of Pin Bars, try and figure out whether or not they are good or bad Pin Bars with respect to their form and the candles that precede them.

Buyers maintained control during the beginning of the session but by the end sellers took over and drove price back down below the open of the candle. Most of the time it would seem logical to continue in the direction you’re going. Do you have any suggestions or questions regarding this strategy? You can always discuss Pinbar Trading System with the fellow Forex traders on the Trading Systems and Strategies forum. Conservative entry point is below (above for bullish set-up) the nose bar. Andrea Unger and Unger Academy can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies.

Price Action Pin Bars – DailyFX

Price Action Pin Bars.

Posted: Thu, 02 Jun 2022 07:00:00 GMT [source]

It is, but only when combined with other factors, including the quality of the pin bar itself and whether it formed at a key level, among others. It must have a wick that is at least two-thirds of the candlestick’s range. So the body of the candlestick must be relatively small compared to the overall size of the pattern.

For swing trading, I tend a portion off at swing high/lows areas. I have 2 trading approach, Trend Following and swing trading. You explain things so clearly and simply reflecting expertise and experience. I don’t know if I will now, but tks to your article I understand more about them. This review is based on my own experience and is my genuine opinion.

Live Trading with DTTW™ on YouTube

A pullback is a common occurrence when you have a strong pin bar. Candlestick reversal pattern has the form of a pin bar does mean it’s a trade-worthy pin bar signal. When the period opened, buyers took immediate control of the market and pushed prices up aggressively. As price reached the top of the wick, sellers were able to come into the market with sufficient supply to hold off higher prices.

In fact, I suggest taking into context of the markets you’re trading, irrespective of the candlestick patterns you’re trading. The psychological boost a trader gets from having his or her first profitable forex strategy is huge. It gives you the confidence to believe that earning a living from forex trading is possible and that helps persevere through any difficulties. If you are going short on a bearish pin bar, enter short when the next candle opens and ticks below the low of the bearish pin bar.

Inside pin bars are exactly what their name suggests; pin bars that are also inside bars. These setups seem to work best in trending markets and on the daily chart time frames. A conservative trader might want to exit at this point, but the strength of the pin bar would tell a more aggressive trader to move the stop loss up and wait for a continuation.

Trade ideas and setups on the daily, 4hr and 1hr chart are highly probable when supported by the weekly HTF bias. A trade can be taken if a pin bar is very obvious, clear and backed by other confluences at the consolidation equilibrium (mid-point) and at the extreme high and low. Pin bar signals at these market extremes are often seen with impulsive price movement towards the equilibrium and the opposite end of the consolidation. As an order flow trader, at the core of most my strategies is volume analysis.

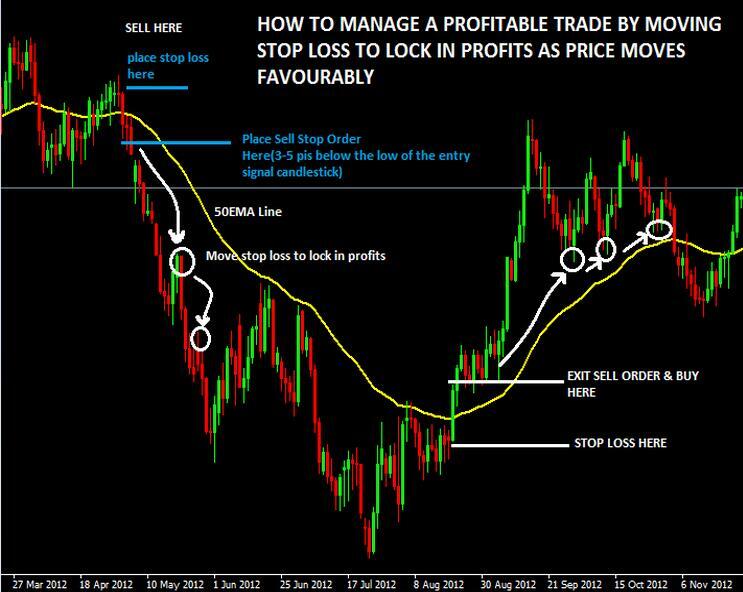

There are other stop loss placements for my various setups taught in our advanced price action guide. Use Price Action Rules – This approach involves applying simple support/resistance rules, in a combination with chart and candle patterns. Why exit a trade, where the price is still trending in our favor? If the price breaks a crucial support during our long trade, this can be a clear sign that we should close the trade. Also, if you spot another reversal candle pattern when the price is trending in your favor, you might want to close your trade at that time. The are many options available for the astute price action trader to manage their pin bar trade.

Once you’ve confirmed a strong trend look to play a pin bar bounce off the moving average. A Shooting Star is bearish reversal pattern that forms at the end of an advance in price . Sellers held control during the start of the session but by the end of the session the buyers stepped in and take price close to highs. The end result is a candle with a long lower tail or wick which will exceed below the most recent price action.

A pin bar is a price action strategy that shows rejection of price and indicates a potential reversal is imminent. An inside bar is a price action strategy that shows consolidation and that a potential breakout is imminent. These two signals, when combined, result in either a ‘pin bar combo’ pattern or an ‘inside bar – pin bar combo’ pattern. If you just go over you charts and just look at pin bars and just do a quick back test, you will see how profitable this forex chart candlestick pattern can be. This four-hour chart of the EUR/GBP currency pair is courtesy of eToro.

This channel will help you improve your trading, know the markets better, and apply the scientific method to financial markets. The other two patterns we’re going to see today are called Shooting Star and Hanging Man. They are symmetrical to the Hammer and Inverse Hammer patterns, which means that we have a predominantly upward trend followed by our reference candlestick, so our Pin Bar. These patterns represent a reversal followed by a downward trend. In technical analysis, especially in Forex trading, Pin Bars are graphic patterns that indicate price inversions.

The word ‘edge’ comes from the idea that the occurrence gives a trader an ‘edge’ over other market participants. The pin-bar candlestick pattern, when traded at areas of support & resistance and in the direction of the trend provides such an edge. Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon.

So the first thing I wanted to do was understand if these patterns could be useful from this market. So let’s move on to the practical part of this video and open the Power Language Editor. As you can see, I have already coded an indicator that can identify these candlestick patterns. To do this, I used an efficiency ratio, which is a value that confirms the presence of trends.

- I went from being a cog in the machine in a multinational company to the only 4-Time World Trading Champion in a little more than 10 years.

- The Hammer and the Shooting Star are types of pin bar candle patterns.

- Remember, the bigger the Pinbar , the stronger the price rejection.

- In this case, the wick is more than five times the size of the body.

- Any opinions, news, research, analysis, prices, or other information contained on this website does not constitute trading or investment advice.

In this blog we present the pin bar pattern in concert with Fibonacci retracements and trend analysis as building blocks to a profitable forex strategy. Pin bars can be taken at major market turning points counter-trend if they are very well formed. Often times long-term trend changes are set off by large pin bars that can result in some serious gains for traders aware of the potential. The daily USD/JPY chart below demonstrates how a large, well formed pin bar can tip off traders to longer-term changes in trend direction. Often times trend changes will occur rapidly and form what is called a “V” bottom with the bottom bar being a pin bar. For more information on trading pin bars and other price action patterns, click here.

The forex pin bar trading strategy bar, however, is a powerful price action setup that tells a fascinating story concerning price momentum and the possibility of an imminent reversal in price direction. The price continues the decrease with an even sharper pace. At the end of the second bearish impulse, the price action enters into a consolidation phase. Note that the consolidation resembles a symmetrical triangle. The upper level of this chart pattern could be used to close our short trade in this case.

The pattern should be confirmed by the bearish candle that opens below the body of the pin bar. This signal shows that bulls tried to push the price higher, but their attempts got rejected. When trading a pin bar counter to, or against a dominant trend, it’s widely accepted that a trader should do so from a key chart level of support or resistance. The key level adds extra ‘weight’ to the pin bar pattern, just as it does with counter-trend inside bar patterns. Any time you see a point in the market where price initiated a significant move either up or down, that is a key level to watch for pin bar reversals. As you can see, there are both bearish and bullish pin bar patterns, and in this case, a pin bar formation is a single candlestick, not a series of two, three or more candles.

In this case, the sell-stop will be triggered if the pin bar pattern is confirmed. At the same time, the stop-loss will help to protect you if the pattern is not triggered. In a bullish candle, the upper side of the candlestick pattern is usually the highest price during a session while the lower part is the lowest price during the session. Similarly, during a bearish candlestick, the lower part is the lowest point of the session and vice versa. An invaluable skill that lets you better time your entries and exits.

- So let’s move on to the practical part of this video and open the Power Language Editor.

- Volume is hands down the number one indicator used in almost every strategy I trade.

- The distance between the entry level and the end of the longer candlewick is the approximate distance that should be allowed for the trade to work.

It merely indicates uncertainty, as weak hands cash in their gains, and smarter ones hold on. Trend trading is the most reliable, predictable and safest method of trading forex. I think a lot of trader’s learn about pin bars and other candlestick patterns when they’re new to trading and think they’re useless. We don’t just trade any old pin bar, because not all pin bars are created equal. We want to trade pin bars that form at swing lows in an uptrend or at swing highs in a downtrend.